25 August, 2017

The Company is engaged in the liquefied natural gas (LNG) and liquefied petroleum gas (LPG) shipping sectors, as well as in the operations in the offshore production, storage and transportation sector.

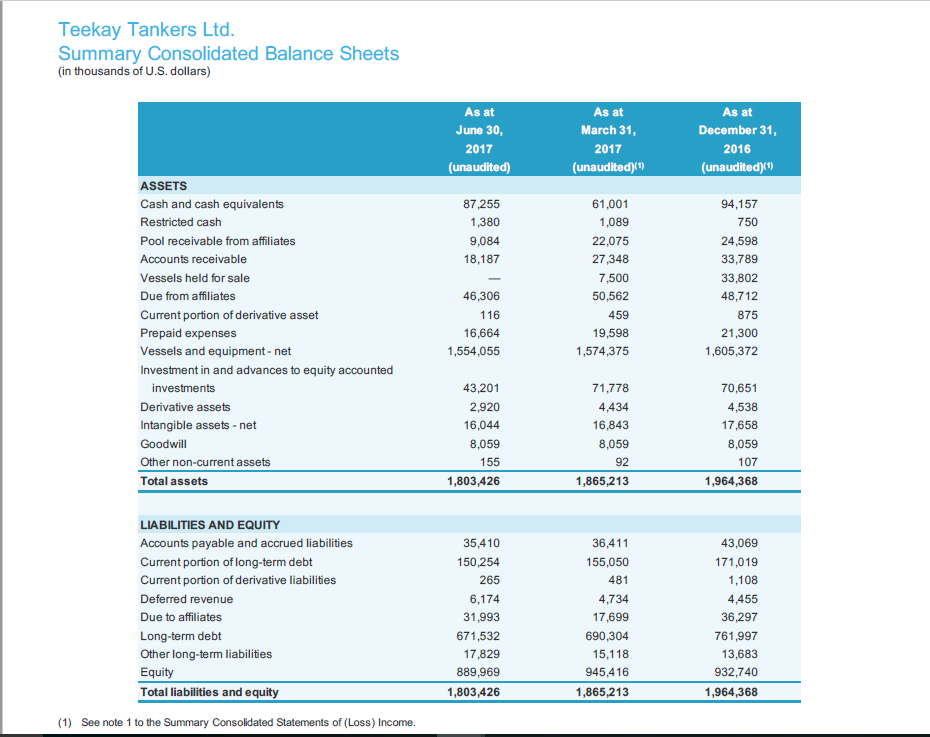

12/17/2015 - Teekay LNG Partners L.P. had its "sector perform" rating reiterated by analysts at RBC Capital. The value of the total investment in Teekay Offshore Partners L.P. C decreased from $4,018,000 to $2,105,000 a change of 47.6% for the reporting period.

In the latest earnings report the EPS was $-1.42 and is projected to be $-1.11 for the current year with 86,259,000 shares outstanding.

12/18/2015 - Teekay LNG Partners L.P. had its "overweight" rating reiterated by analysts at JP Morgan.

Teekay Offshore Partners L.P. had a return on equity of 5.24% and a net margin of 11.51%.

Teekay Corporation (NYSE:TK) last issued its earnings results on Thursday, August 3rd. Analysts expect next quarter's EPS to be $0.15 and the next full year EPS is projected to be $0.06. Teekay Offshore Partners L.P. Teekay Offshore Partners L.P.'s revenue was down 14.0% on a year-over-year basis. The company had revenue of $244.60 million during the quarter, compared to analyst estimates of $270 million.

09/13/2016 - Jefferies began new coverage on Teekay LNG Partners L.P. giving the company a "hold" rating. ValuEngine raised Teekay LNG Partners L.P. from a "hold" rating to a "buy" rating in a report on Friday, June 2nd. BidaskClub lowered shares of Teekay Corporation from a "hold" rating to a "sell" rating in a report on Wednesday, July 12th. Finally, Stifel Nicolaus reissued a "hold" rating and set a $16.00 price objective on shares of Teekay LNG Partners L.P.in a report on Thursday, July 6th.

On June 9 the stock rating was downgraded to "Underweight" from "Equal-weight" in an announcement from Morgan Stanley. Overall, volume was down 90.03% under the stocks normal daily volume. Institutional investors own 52.52% of the company's stock.

12/11/2014 - Canaccord Genuity began new coverage on Teekay LNG Partners L.P. giving the company a "buy" rating. As of quarter end Wfg Advisors, Lp had bought a total of 1,408 shares growing its stake by 15.4%. Scotia Capital Inc. now controls 46,397 shares worth $309,000. Investment Centers of America Inc. boosted its stake in shares of Teekay LNG Partners L.P.by 2.2% in the first quarter. Raymond James Financial Services Advisors, Inc. augmented its investment by buying 113,300 shares an increase of 55.5% from 03/31/2017 to 06/30/2017. Global X Management Co.

12/10/2014 - ABN Amro began new coverage on Teekay LNG Partners L.P. giving the company a "buy" rating. LLC now owns 19,822 shares of the shipping company's stock worth $348,000 after buying an additional 564 shares during the last quarter.

11/21/2014 - Teekay LNG Partners L.P. had its "neutral" rating reiterated by analysts at Citigroup. Janney Montgomery Scott LLC now owns 168,047 shares of the shipping company's stock valued at $852,000 after buying an additional 41,165 shares in the last quarter. Hedge funds and other institutional investors own 43.51% of the company's stock. Parkside Financial Bank & Trust raised its stake in shares of Teekay Offshore Partners L.P.by 7.3% in the first quarter. The company had a trading volume of 70,776 shares. The firm's market capitalization is $805.66 million.

Shares are trading at $9.34 which is marginally higher than $8.60, the 50 day moving average and significantly above the 200 day moving average of $8.35.

The firm also recently announced a quarterly dividend, which was paid on Friday, August 11th. Teekay Corporation also recently declared a dividend for shareholders that was paid on Wednesday the 16th of August 2017. This dividend represents a yield of $2.58. Teekay Corporation's payout ratio is -15.38%.

ILLEGAL ACTIVITY WARNING: This piece was reported by TrueBlueTribune and is owned by of TrueBlueTribune.

According to Zacks, "TEEKAY OFFSHORE PARTNERS L.P.is a publicly-traded master limited partnership formed by Teekay and is an worldwide provider of marine transportation and storage services to the offshore oil industry".