28 July, 2017

Flinton Capital Management LLC increased its position in shares of Chesapeake Energy Corporation by 25.4% in the first quarter. Public Employees Retirement System of Ohio's holdings in Chesapeake Energy Corporation were worth $1,641,000 as of its most recent SEC filing. In that case, its shares would mark a 7.33% decline from the most recent price. The stock had a trading volume of 22,050,110 shares. Chesapeake Energy Corporation has a 52 week low of $4.38 and a 52 week high of $8.20. the firms valuation is $4.51 B. Chesapeake Energy Corporation also was the target of unusually big options trading on early Monday. About 202,972 shares traded. It has underperformed by 16.70% the S&P500. It also reduced Whiting Petroleum Corp. Manufacturers Life Ins Company The reported 2,295 shares stake. Assured Guaranty Limited (NYSE:AGO) was reduced too.

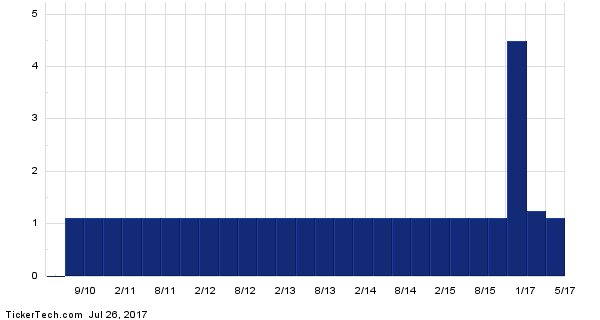

Since March 3, 2017, it had 4 insider buys, and 0 insider sales for $3.37 million activity. Shares for $2.62M were bought by DUNHAM ARCHIE W on Wednesday, March 8.

Investors sentiment decreased to 1.61 in 2016 Q4. Its up 0.10, from 1.63 in 2016Q3. 75 funds opened positions while 177 raised stakes. A simple moving average (SMA) is an mathematical moving average calculated by adding the closing price of the security for a number of time periods and then dividing this total by the number of time periods. Victory holds 0% or 14,237 shares. Putnam Investments LLC raised its position in shares of Chesapeake Energy Corporation by 6.9% in the fourth quarter. Goldman Sachs Grp Inc, a New York-based fund reported 18,994 shares. Wunderlich maintained Chesapeake Energy Corporation (NYSE:CHK) rating on Thursday, March 30. Finally, Fox Run Management L.L.C. bought a new stake in shares of Chesapeake Energy Corporation during the second quarter worth $115,000.

Chesapeake Energy Corporation (NYSE:CHK) transacted up 4.55% on Early Thur, reaching $5.06. the firms shares had a trading volume of 43,584,182 Stocks. the company has 50 Day SMA of $4.83 along with a 200 - day SMA of $5.57. Morgan Stanley invested in 0% or 245,543 shares. Raymond James Associates reported 12,830 shares. Parsons Cap Management Ri owns 105,441 shares or 0.1% of their U.S. portfolio. Salem Investment Counselors has invested 0% of its portfolio in Chesapeake Energy Corporation (NYSE:CHK). The consensus recommendation provided by covering sell-side analysts is now 2.90.

The Target Price for Chesapeake Energy Corp (NYSE:CHK) is $5.72/share according to the consensus analysis of analysts working on the stock. Stifel Nicolaus reissued a "buy" rating on shares of Chesapeake Energy Corporation in a report on Friday, July 21st. Also, Director R Brad Martin purchased 20,000 shares of Chesapeake Energy Corporation stock in a transaction dated Friday, May 26th. On June 21 the stock rating was downgraded to "Underperform" from "Neutral" in an announcement from Macquarie. The rating was maintained by RBC Capital Markets on Tuesday, August 11 with "Sector Perform". On Wednesday, January 27 the stock rating was maintained by RBC Capital Markets with "Outperform". Keefe Bruyette & Woods upgraded the shares of ARES in report on Friday, March 24 to "Outperform" rating. Chesapeake Energy Corporation presently has a consensus rating of "Hold" and a consensus target price of $6.63. The company was upgraded on Friday, October 21 by Bank of America.

Chesapeake Energy Corporation produces natural gas, oil and natural gas liquids (NGL) in the United States. The stock had its last split on Jul 1, 2014. GRAVES EARL G JR had sold 1,000 shares worth $714,955. STRADFORD DENNIS P sold $108,752 worth of stock or 3,000 shares. HANNA JOSEPH F had sold 6,000 shares worth $207,313.

Investors sentiment increased to 1.73 in 2016 Q4. Its down 0.15, from 1.76 in 2016Q3. 16 funds opened positions while 42 raised stakes. Barrow Hanley Mewhinney & Strauss Limited Co holds 0.15% or 13.63M shares in its portfolio. Suntrust Banks Inc holds 269,023 shares.

Brokerage houses, on average, are recommending investors to buy Twenty-First Century Fox, Inc. Principal Fin holds 0% of its portfolio in Otter Tail Corporation (NASDAQ:OTTR) for 9,229 shares. Metropolitan Life Insurance Ny reported 15,800 shares or 0% of all its holdings. 63,527 are held by Manufacturers Life Insurance Comm The. That's still the main focus of Chesapeake and it should still be the main focus for investors in shares. 19,600 were accumulated by Dekabank Deutsche Girozentrale. 97,915 are owned by Wolverine Asset Mngmt Ltd Liability Co. Caisse De Depot Et Placement Du Quebec holds 1.58% or 794,713 shares. The Tennessee-based Southeastern Asset Management Inc Tn has invested 3.37% in the stock. Geode Cap Mgmt Limited Liability holds 0.01% or 320,641 shares in its portfolio. (NYSE:AZO) to report earnings on September, 28. Increasing profits are the best indication that a company can pay dividends and that the share price will trend upward. The consensus mean EPS for the current quarter is at $0.15 derived from a total of 27 estimates from the analysts who have weighed in on projected earnings.

Autozone, Inc.is a retailer and distributor of automotive replacement parts and accessories in the United States.

Market cap - or market capitalization - refers to the total value of all a company's shares of stock. The Firm offers three ways for people to make Snaps: the Snapchat application, Publishers Tools that help its partners to create Publisher Stories, and Spectacles, its sunglasses that make Snaps. It has a 28.72 P/E ratio. The Auto Parts Locations segment is a retailer and distributor of automotive parts and accessories.